Navigating Savings: The Impact of Federal Tax Credits on Solar Panel Home Installations

Installing solar panels at home not only contributes to sustainability but also opens the door to valuable federal tax credits. In this exploration, we’ll delve into the significant impact these credits have on making solar power a financially attractive choice for homeowners.

Understanding the Federal Incentive: Solar Tax Credits Unveiled

Federal tax credits for solar panel home installations are part of government incentives to encourage the adoption of renewable energy. The Investment Tax Credit (ITC) allows homeowners to claim a percentage of the installation cost as a credit against their federal tax liability. This incentive significantly reduces the overall cost of installing solar panels.

Economic Advantages: Unleashing Savings for Homeowners

The primary benefit of solar panel home federal tax credits is the economic advantage they bring to homeowners. The ITC allows eligible homeowners to claim up to 26% of the total solar installation cost, making the upfront investment more affordable. This substantial reduction in the initial expense enhances the financial appeal of transitioning to solar energy.

A Boost for Energy Independence: Financial Support for Solar Adopters

Solar panel home federal tax credits act as a significant boost for those aiming for energy independence. By providing financial support, the government actively encourages homeowners to invest in solar power, reducing dependence on traditional energy grids. This move towards energy self-sufficiency aligns with broader sustainability goals.

Environmental Stewardship: Promoting Green Choices

The connection between federal tax credits and environmental stewardship is evident. By incentivizing solar panel installations, the government promotes eco-friendly choices. Homeowners who leverage these credits actively contribute to reducing carbon footprints, aligning with national and global initiatives to combat climate change.

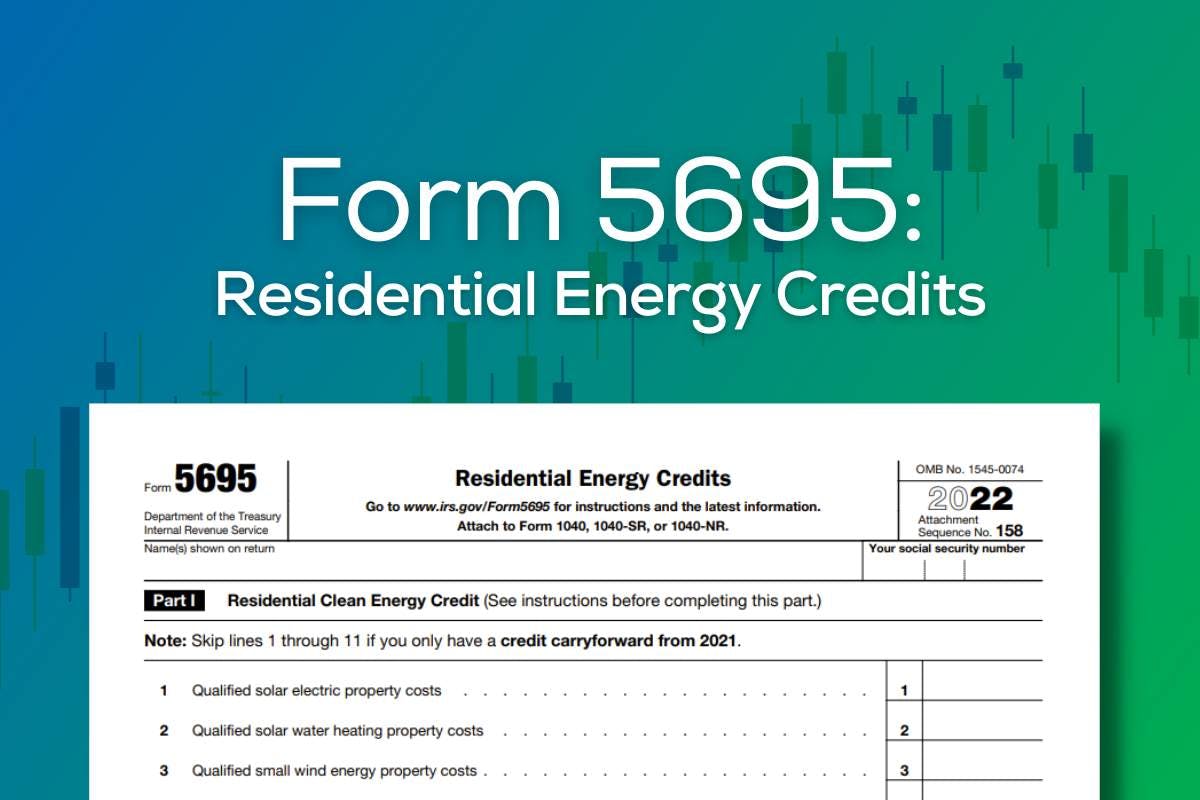

Accessible Incentives: How Homeowners Can Qualify

Qualifying for solar panel home federal tax credits involves meeting certain criteria. Homeowners must own the solar panel system, and it must be installed in the residence. Additionally, the system must meet the energy efficiency standards set by the government. Ensuring compliance with these requirements is crucial for claiming the tax credits.

Planning for the Future: The Phased Reduction of Tax Credits

While the current solar panel home federal tax credit offers a substantial 26% reduction, it’s essential to note that this percentage is slated to decrease in the coming years. Homeowners planning to take advantage of the maximum savings should consider the phased reduction and plan their installations accordingly to maximize benefits.

Professional Guidance: Navigating the Tax Credit Landscape

Understanding the intricacies of solar panel home federal tax credits can be complex. Seeking professional guidance is advisable to ensure accurate and optimal utilization of available incentives. Tax professionals and solar installation experts can provide tailored advice based on individual circumstances, helping homeowners make informed decisions.

Exploring Solar Opportunities: Solar Panel Home Federal Tax Credits at ctproductsandservices.com

Discover the full scope of opportunities presented by solar panel home federal tax credits at ctproductsandservices.com. This platform serves as a comprehensive resource, offering insights into available incentives and providing information to guide homeowners through the process of claiming tax credits.

Conclusion: Maximizing Savings, Minimizing Footprints

In conclusion, solar panel home federal tax credits play a pivotal role in making solar power an attractive and financially viable choice for homeowners. Beyond the economic advantages, these incentives contribute to environmental stewardship and energy independence. As the solar industry continues to grow, leveraging federal tax credits becomes a strategic step towards maximizing savings and minimizing carbon footprints.

.jpg)