Federal Tax Credits: Powering Solar Savings

3 min read

Harnessing Solar Power Savings: A Guide to Federal Tax Credits

As the world embraces sustainable energy solutions, solar panel federal tax credits emerge as key incentives, driving the adoption of solar technology. This article explores the nuances of these credits, shedding light on their significance for individuals and businesses seeking to make the switch to solar power.

Understanding Federal Tax Credits for Solar Panels

Federal tax credits for solar panels are financial incentives provided by the government to encourage the use of solar energy. These credits allow individuals and businesses to deduct a percentage of their solar installation costs from their federal taxes, making solar technology more financially accessible.

The Investment Tax Credit (ITC) in Detail

The primary federal tax credit for solar panels is the Investment Tax Credit (ITC). The ITC allows individuals and businesses to claim a percentage of their solar expenditures as a credit against their federal income tax liability. As of [current year], the ITC offers a substantial credit, making solar investments more attractive.

Residential Solar Credit Eligibility

For residential solar projects, homeowners are eligible for the federal tax credit, covering a percentage of the total solar installation cost. Eligibility criteria may vary, but generally, the property must be the taxpayer’s primary residence, and the solar panels must meet specific efficiency and certification standards.

Commercial Solar Credit Opportunities

Businesses, too, can benefit from federal tax credits for solar installations. The ITC extends to commercial solar projects, providing a significant incentive for businesses to invest in clean energy solutions. This credit can be instrumental in offsetting the initial costs of solar panel installations for commercial properties.

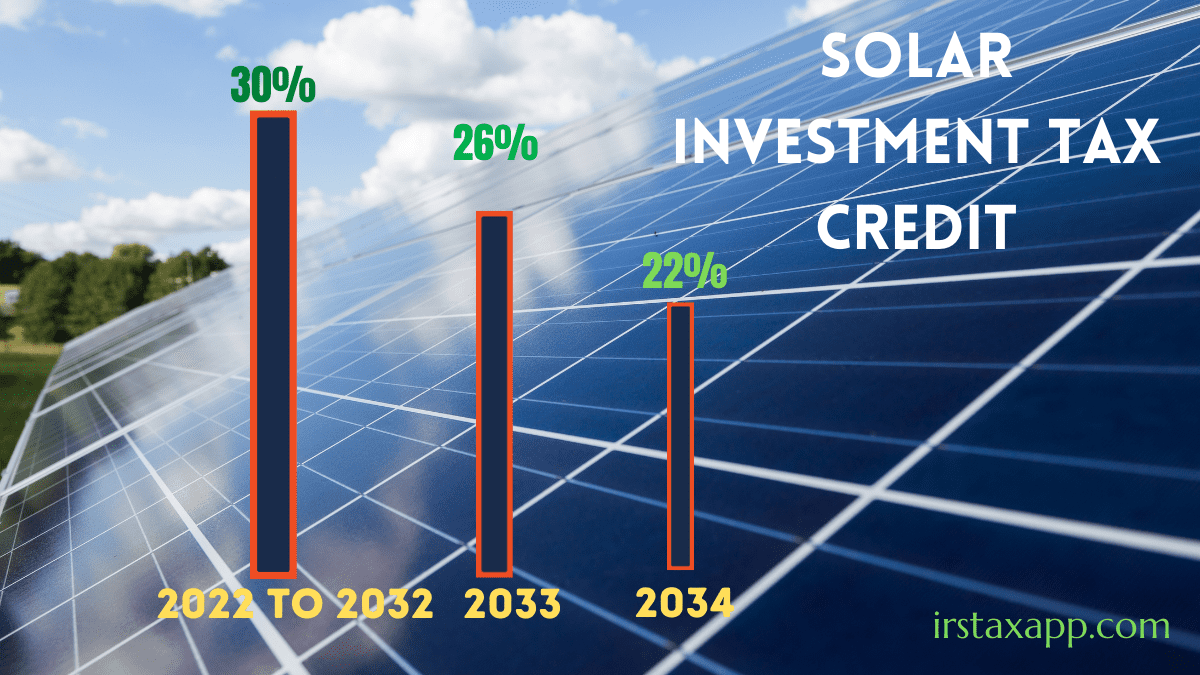

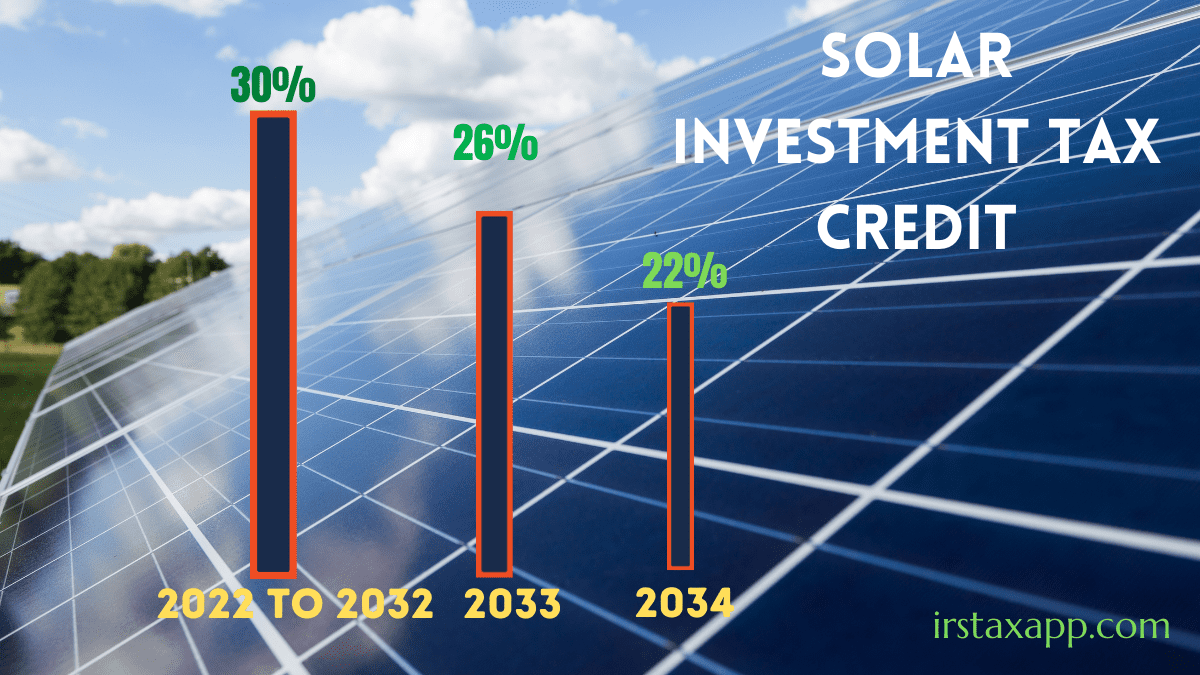

Navigating the Phasedown of Solar Tax Credits

It’s crucial to be aware of the phasedown schedule for federal tax credits. The ITC, initially set at a higher percentage, undergoes gradual reductions over time. Staying informed about these phasedown schedules is essential for individuals and businesses planning solar installations to maximize their tax credit benefits.

Impact of Federal Solar Credits on Affordability

The availability of federal tax credits significantly impacts the affordability of solar panel installations. By reducing the upfront costs, these credits make solar technology a more feasible option for a broader range of consumers. The combination of tax incentives and long-term energy savings creates a compelling financial case for adopting solar power.

State and Local Incentives in Conjunction

In addition to federal tax credits, many states and local governments offer their incentives and rebates for solar installations. Combining federal incentives with these regional programs can further enhance the financial benefits of going solar. It’s advisable to explore and leverage all available incentives for maximum savings.

Consulting with Tax Professionals for Guidance

Navigating the complexities of tax credits requires a clear understanding of tax laws and regulations. Seeking guidance from tax professionals or certified solar tax credit experts can ensure that individuals and businesses fully capitalize on available incentives and comply with relevant tax codes.

Economic and Environmental Benefits of Solar

Beyond the financial advantages, adopting solar technology brings forth economic and environmental benefits. Solar panels contribute to energy independence, reduce electricity bills, and decrease reliance on non-renewable energy sources. Additionally, the environmental impact of solar power aligns with global efforts to combat climate change.

Solar Panel Federal Tax Credits: A Link to Savings

To explore comprehensive information about solar panel federal tax credits and their application, visit Solar panel federal tax credits. This resource provides insights and guidance for those looking to harness the full potential of federal tax incentives, unlocking significant savings on their solar investments.

Conclusion: Powering a Sustainable Future

In conclusion, federal tax credits play a pivotal role in making solar power an economically viable and attractive option for individuals and businesses alike. The ITC and other incentives not only reduce the financial barriers to entry but also contribute to a sustainable and cleaner energy future. By leveraging these credits, individuals and businesses can power not only their properties but also the transition to a more sustainable world.